Thanks to an extensive experience in the construction sector, together with our technical team of highly skilled specialists, AB ENGINEERING is specialized in technological system and building design, which encompasses civil, industrial, commercial and tertiary sector. Our dynamic and dedicated team is constantly updating at the leading edge of new means, methods and technology.

For projects requiring expertise in related fields, AB ENGINEERING has developed long-standing professional relationship with industry experts, that we bring onto our team to deliver outstanding products and services. Together with our alliance partners, we are committed to performing refurbishment, upgrade and installation of electrical and thermal systems, powered by renewable resources as well as traditional sources.

Also, we deal with installation of plants, air-conditioning, water and sanitary, fire alarm systems, air treatment and waste management system.

Thanks to our expertise in energy management, we are able to combine the real needs and technological requirements with system optimization and energy savings.

Contact us to find out more about our sustainable building projects, services and technology.

PHOTOVOLTAIC SYSTEMS

AB Engineering has 30 Megawatt-experience in photovoltaic systems from design, planning stages to completion for installation of all sizes. Thus, contact our Accredited Professionals to discuss your next photovoltaic system project, so we can help you to find the best tailor-made solutions, in order to ensure all requirements are met and that optimum renewable system is delivered.

Our company offers several services, as follows:

- feasibility studies, technical and economic assessment, accounting;

- study of legislative, environmental regulations and those related to the installation site of photovoltaic systems (required for grounding systems);

- urban planning and connection, authorizations’ management in the institutions involved;

- architectural and electric design;

- technical and economic consultative assistance on the supply choice and the procurement services;

- construction site supervision, selection and coordination of companies;

- financial practice and fulfillment management, relationship with GSE (Gestore Servizi Energetici), namely an Italian company, aimed at fostering environmental sustainability through promotion and development of renewable energy sources, by providing support for their utilization.

AB Engineering offers a full turnkey solution to our clients, specializing in design service, technical management, procurement and plant installation, made by our expert installers.

Our price lists are constantly up-to-date, in order to find best solutions to suit each of our customers different needs and budgets, at an affordable price.

Upon the completion and connection of photovoltaic power generation system to the electrical grid, we offer a 360° general property maintenance service, which includes:

- cadastral surveying;

- testing and monitoring installation productivity;

- electrical testing and thermography;

- annual consumption statement to GSE and customs;

- relationship with authorities and tax management;

- all other fulfillments, annual and periodical surveys.

TAX RELIEFS AND INCENTIVES FOR PHOTOVOLTAIC SYSTEM

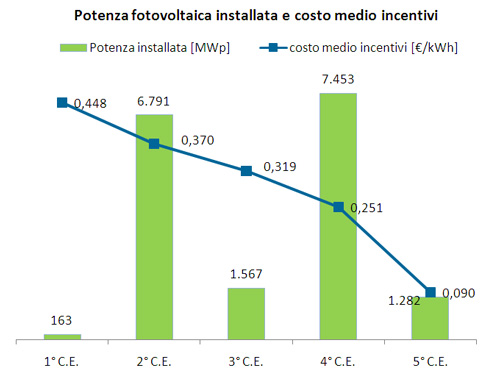

Previous energy law in Italy

As regards the energy production from solar photovoltaic source, it has been possible to benefit from government incentives provided by GSE S.p.A. in “Feed-in Tariff (FIT) scheme” (the so-called Conto Energia). The FIT for photovoltaic system stops 30 days after reaching an indicative yearly cumulative cost and this limit was reached on 6th June 2013, determining the cessation to require incentives to GSE, except for those which are enrolled in the register for big-sized plants and entered into balance sheet within one year. From now on, the PV sector is expected to work without FIT, by taking advantages of fiscal benefits, regulatory framework and new market opportunities dealing with self-consumption systems.

New policy framework

The new Italian “Stability Law” 2014 introduces important news to foster fiscal benefits for interventions, concerning energy efficiency retrofit and building heritage recovery. This Act extended the eco-bonus from 36% to 50% for energy improvement and anti-seismic retrofit interventions in 2014 and up to 40% until 31st December 2015 for building renovations. So, it is possible to deduct on IRPEF (income tax of natural person) a portion of expenses incurred to renovate houses and common area in residential building in Italy. With the Resolution no. 22/E of 2nd April 2013, Italian Revenue Authority set out that this tax deduction has to be applied also to installation of solar photovoltaic systems, as an alternative to the policy in “FIT” and taking into consideration the legislative framework, as follows:

- 50% tax deduction, recoverable in 10 years on the cost of implementation’s plant;

- energy savings, indicated in the bill (in the last few years, the average cost is increased by 67%);

- the opportunity to benefit from the net metering conventions on the site or GSE simplified purchase e resale rearrangements, which may be accumulated with tax deduction.

The implementation of a photovoltaic system is still profitable, for example a plant for domestic use, equipped with own consumption (3-6 kW) and 20 years working life, will offer a payback period not longer than 8 years.

SOLAR THERMAL SYSTEMS

When existing building are retrofitting with solar thermal systems, the integration of solar thermal components into existing systems must be made as easy as possible. In fact, we can use solar thermal energy for domestic or industrial water heating and above all it is completely renewable sources produced directly by sunlight. Solar thermal systems combine space heating and produce domestic hot water (DHW). The integration of solar thermal into conventional heating systems is important, because it allows to ensure good conditions for the performance.

A solar water heating system can be also used to heat a swimming pool during the summer and it can provide a large amount of the heating demand. The low solar energy density makes possible the use of hot water at not so high temperature (between 40°C and 80°C), suitable for DHW and for space heating, which benefits from low-temperature systems, radiant-floor heating system and wall heaters (up to 60°C).

For the installation, it is recommended to take into consideration the following factors:

- south-facing rooftop availability;

- high grade solar collector (40°C-90°C);

- low temperature of heating and plumbing loop

- radiant-floor heating system and wall heaters

- buildings with good thermal insulation.

The heat distribution system can supply both domestic hot water and space heating. The heat transfer unit are used to control the space heating loop flow, return temperature and supplies heat by using a heat exchanger, which transfers heat from one fluid (heated collector fluid) to another (stored water) and it goes in a storage tank (boiler) to be used as needed.

Structural modeling diagram solar thermal combined system

TAX RELIEFS AND INCENTIVES IN SOLAR THERMAL SECTOR

Until December 2013, it was decided to adopt two different ways in the tax deduction field for the installation of solar thermal collectors, as follows:

1) RENEWABLE ENERGY FOR HEATING & COOLING SUPPORT SCHEME (CONTO ENERGIA TERMICO)

The Ministerial Decree of 28th December 2012 the so-called “Renewable Energy for Heating & Cooling Support Scheme” (Conto Termico) introduced financial incentives for the implementation of solar thermal systems and other interventions to improve energy efficiency and to promote thermal energy from renewable sources. This support scheme involves public administration entities and private subjects, such individuals, household, businesses and agriculture enterprises and it provides the following tax deductions:

- incentives on capital costs up to 40% on the eligible investments, recoverable in 2 years, depending on type of implementation, scale and technology;

- incentives are open for private entities, individual condominium and public administrations;

- as regards thermal solar and solar cooling technology, the incentive is calculated per installed square meter: 170€/m2 up to 50 m2 surface and 55€/m2 for installations with a surface area greater than 50m2; as concerns the solar cooling systems, the incentive rises at 255€/m2 and 83€/m2.

2) 65% TAX DEDUCTION

With the approval of the Decree Law no.63/2013,it has been scheduled an extension of the existing tax deduction system for retrofitting works, which went from 55% to 65% and it is possible to benefit from 6th June 2013. These measures can be applied on new solar panels installation for domestic and industrial hot water production and to fulfill the needs of hot water in swimming pools, sport facilities, nursing homes, schools and universities.

The maximum threshold for this deduction is 60.000€, recoverable in 10 years.

OTHER TECHNOLOGY INSTALLATIONS

AB ENGINEERING offers our clients the following services:

- consulting activities, technical and economic feasibility studies and estimates;

- inspections and site surveys;

- study and development of mechanical and electrical-functional representation;

- preliminary, final and executive design of electrical installations, heating and cooling systems, thermal power plants, water and sanitary systems, fire prevention systems, fluid process systems, pressurization systems, tailor-made installations based on the clients’ needs.

- selection, configuration and sizing of machinery, technical devices and components;

- assessment and sizing of air, fluid and electric distribution networks;

- suppliers selection and technical support to assess the best solutions;

- construction site supervision;

- survey and testing by using typical devices;

- management of all necessary authorizations and procedures.